Online Best Expert CA in Greater Noida Start Price @199 click hare…

GST Registration Cancellation

The GST registration cancellation can be voluntarily deleted if the company is inactive or not generating the required turnover. In addition, a GST registration can be canceled by a GST officer if the company fails to comply with GST requirements. Once a GST registration has been cancelled, the individual or entity is no longer required to file a GST return or pay or collect GST.

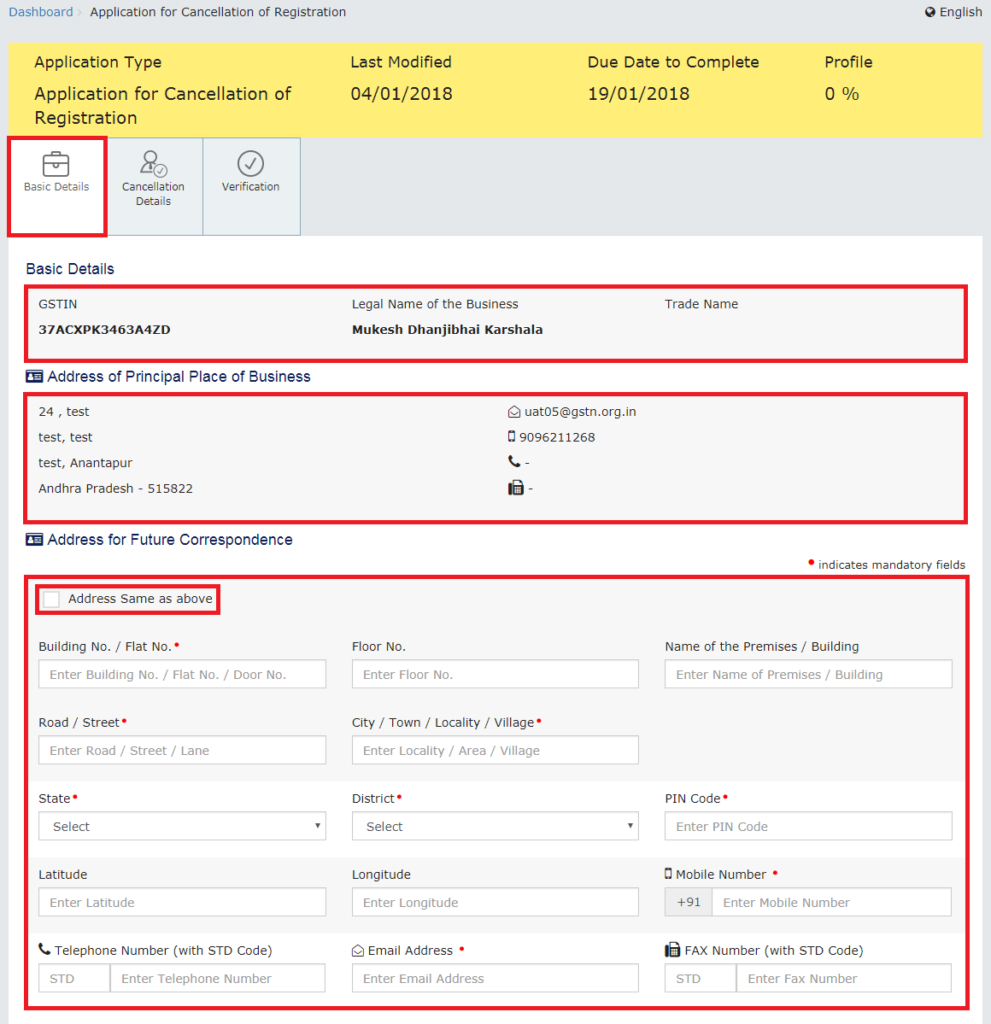

Procedure for GST Registration Cancellation

Step 1: A GST cancellation request is made using the GST REG-16 form on the GST Common Portal.

Step 2: The GST officer must review the request and cancel the order on the GST REG-19 form within 30 days of the date of the request. The cancellation will take effect from the date specified by the agent and will be communicated to the taxpayer.

Documents Required For GST Registration Cancellation

- PAN Card

- Aadhar Card

- Last Return Details

- Company Details

- Tax Particulars

Preparing to Cancel GST Registration

Before beginning the GST cancellation process, the applicant must pay any outstanding GST obligations. In addition, the taxpayer must pay the input tax on stocks of intermediate goods, semi-finished goods, finished goods, and capital goods or the tax due thereon, whichever amount is higher.

The previous tax credit on the current inventory must be returned as the taxpayer will no longer be able to claim the ITC if the GST entry is cancelled. An electronic VAT credit or cash book can be used for a final VAT payment. The final payment may be made along with the filing of the final GSTR 10 statement.

Final Return

- When canceling a GST registration, the individual or entity must submit a final GST declaration on Form GSTR-10 within three months of the cancellation date or the date of order cancellation, whichever occurs first.

- This is to ensure that the taxpayer has no outstanding GST charges. This provision does not apply to suppliers of inputs or non-resident taxpayers who are subject to tax under Sections 10, 51 or 52. If the final GST return is not filed on Form GSTR-10, the taxpayer will receive a notice on Form GSTR-3A, prompting them to do so within 15 days of the issuance of the notice.

- If the taxpayer ignores the notification, the liability of the taxpayer will be determined on the basis of the facts available to the official concerned.

- The assessment order will be overturned if the plaintiff submits a statement within 30 days of receipt of the notice.