What is TDS Return Filing

In addition to paying the tax, the withholding tax administrator must also file a TDS return. Filing a TDS return is a quarterly return that must be filed with the Income Tax Department. Timely submission of TDS returns is essential. The submission of your TDS declaration can be done entirely online. Once the TDS declaration has been submitted, the details will appear on the Form 26 AS.

Understanding TDS Return Filing

When it comes to TDS (Tax Deducted at Source) filing, finding reliable TDS filing services and an experienced accountant or CA (Chartered Accountant) near your location is crucial. Our team of skilled professionals specializes in providing comprehensive TDS filing services tailored to your specific needs. With our expertise, you can ensure compliance with the TDS regulations and avoid any penalties or legal issues. Whether you require assistance with TDS filing or have queries regarding TDS returns, our dedicated team is here to help. Understanding the importance of accurate documentation, we can guide you through the process and provide the necessary support. This includes understanding and obtaining Form 26AS, which provides crucial information about TDS credits. We can also advise you on the documents required for TDS return filing to ensure smooth and hassle-free compliance. Our experienced professionals are well-versed in the process for filing TDS returns and can handle the intricacies on your behalf. Additionally, we provide TDS certification, ensuring that you have the necessary credentials and expertise to navigate the TDS landscape. Don’t hesitate to reach out to us for reliable TDS filing services near you, backed by the expertise of qualified accountants and CAs who are dedicated to providing comprehensive solutions for your TDS-related needs.

Documents Required For TDS Return Filing

- PAN Card

- TDS Certificate

- TDS Acknowlwdgement

- Tax payment Challan

- Bank Statement

What is TAN?

The TAN, or Tax Withdrawal and Collection Number, is a mandatory 10-digit alphabetical number that must be obtained by all persons responsible for withholding or collecting tax withholding on behalf of the government.

Private individuals do not have to obtain a TAN or deduct withholding tax. We ( Taxesquire ) can help you with that.

For real estate, corporations and other entities are required to withhold taxes when making certain payments such as salaries, contractor payments, rent payments over Rs 240,000 per year.

people with a valid TAN number are required to submit TDS feedback once a quarter.

Our TDS experts can help you calculate TDS payments and submit TDS returns in accordance with TDS regulations.

procedure for filing TDS return

Step 1: The multi-column Form 27A must be completed first, and in the case of a paper version of the form.

Step 2: In the next step, the tax withheld and the total amount paid must be filled in correctly and added up.

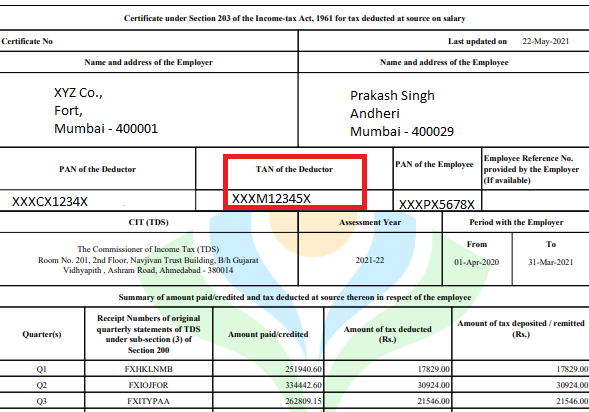

Step 3: The TAN of the organization must be entered on form 27A. If the transmitted TAN is wrong, there will be difficulties with the verification.

Step 4: When submitting the TDS, please provide your Challan number, payment method and relevant tax details.

Step 5: To ensure consistency, use the base form used to submit the e-STDS. To facilitate the counting process, enter the 7-digit BSR code.

Step 6: Physical TDS returns must be submitted to TIN FC managed by NSDL. In the case of an online application, it can be submitted on the official website of the NSDL NIP.

Step 7: If the information provided is correct, you will receive a temporary token number or receipt. This is proof that the TDS declaration has been submitted.

What is a TDS Certificate?

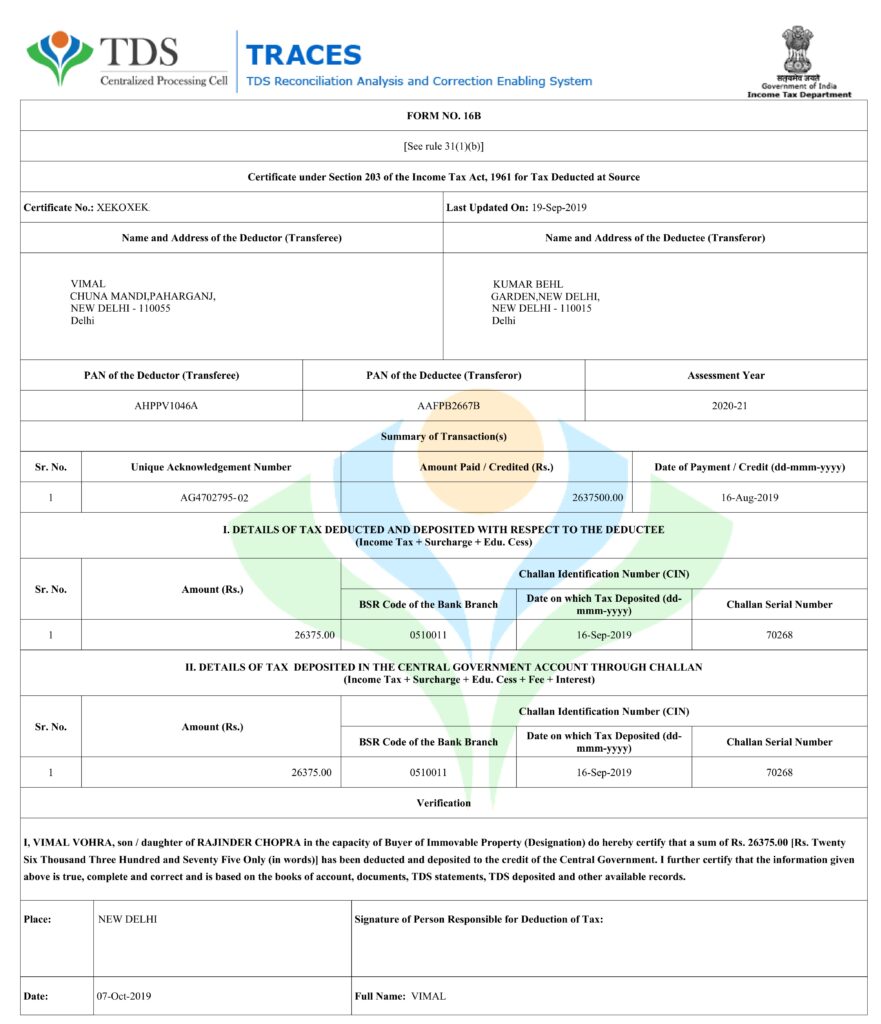

After the TDS has been stripped from the deducer, the TDS certificate must be presented.

The franchise can verify the tax credit by presenting a valid TDS certificate from TRACES that includes the unique 7-digit certificate number and the TRACES watermark. , TDS Certificates held by the franchise. Non-payroll TDS Certificates are issued quarterly and payroll TDS Certificates are issued annually.

If the person whose certificate was denied loses it, they can request a duplicate TDS certificate.