What is Provident Fund?

The Employees Provident Fund is a scheme for Indian employees governed by the provident Funds Act 1952 and various regulations. The employee provident fund is governed by the Employee Provident Fund, popularly known as the EPFO. Employees pay part of their salary into a provident fund and employers have to pay contributions for their employees. The money in the fund is then held and administered by the government and eventually withdrawn by retirees or their bereaved in countries.

The PF scheme also provides several other benefits, such as life insurance, disability insurance, and housing loan facilities to its members. The scheme is an important social security measure that ensures that employees have a financial cushion after their retirement.

EPFO & ESIC

The EPFO portal is a dedicated platform that provides various services related to the Employees’ Provident Fund Organization. It serves as a one-stop solution for provident fund registration and offers a range of EPFO services to both employers and employees. To complete the PF registration process, certain documents are required, including proof of identity, address proof, and details of the organization. Additionally, ESIC registration is essential for employers to provide health insurance benefits to their employees. ESIC offers a comprehensive range of services, including medical, maternity, disability, and dependent benefits. Registering for PF and ESIC brings several benefits, such as financial security for employees, tax benefits, and access to medical facilities. It is important to have the necessary documents in place for both PF and ESIC registration to ensure a smooth process. Our team specializes in assisting organizations with PF and ESIC services, ensuring compliance with regulations and maximizing the benefits for both employers and employees. Contact us today to explore the services offered by EPFO and ESIC and streamline your organization’s employee welfare programs.

Documents Required for Provident fund Registration?

- PAN of the Partner, Proprietor, or the Director

- Address proof

- Canceled Cheque

- Bank Statement

- Aadhaar Card

- Digital Singnature

- Certificate of Incorporate

Procedure for Provident Fund

- Fill up from

- Submit documents

- Submit Application

- Your work is done

What is Employee State Insurance Corporation?

National Employment Insurance (ESI) is administered and regulated by the Employee Insurance Corporation, an autonomous body of the Indian Department of Labor and Employment. The ESI program was introduced for Indian workers, which provides the worker with cash, medical treatment and other benefits from the employer.

Benefits of Employee State Insurance Corporation Registration

- The benefits of complete medical care and insurance

- Maternity leaves for pregnant women

- Dependent benefits

- Old Age Medical Care

- etc.

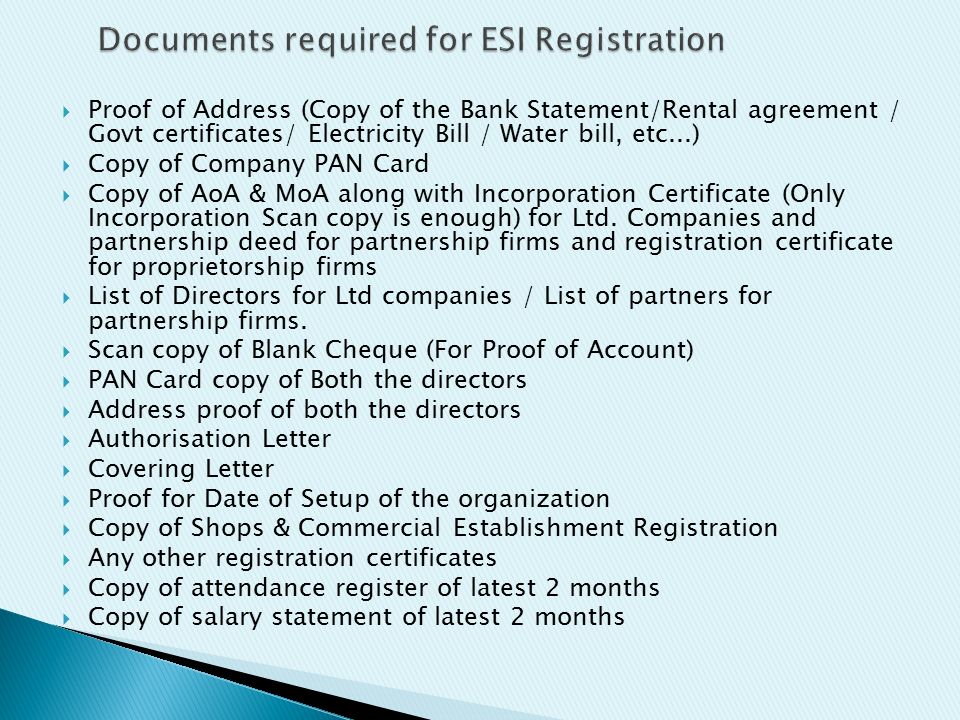

Documents Required for ESIC Registration

- Registration Certificate of Shops and Establishment Acts

- Address Proof (business)

- PAN Card

- Latest Bank Statement

- MoA & AoA of depending on the entity nature

- Photocopy of certificate of Commencement of production

Procedure for Employee State Insurance Corporation Registration

- Fill up application form

- Submit documents

- Verification

- Submission of application from

- your work is done