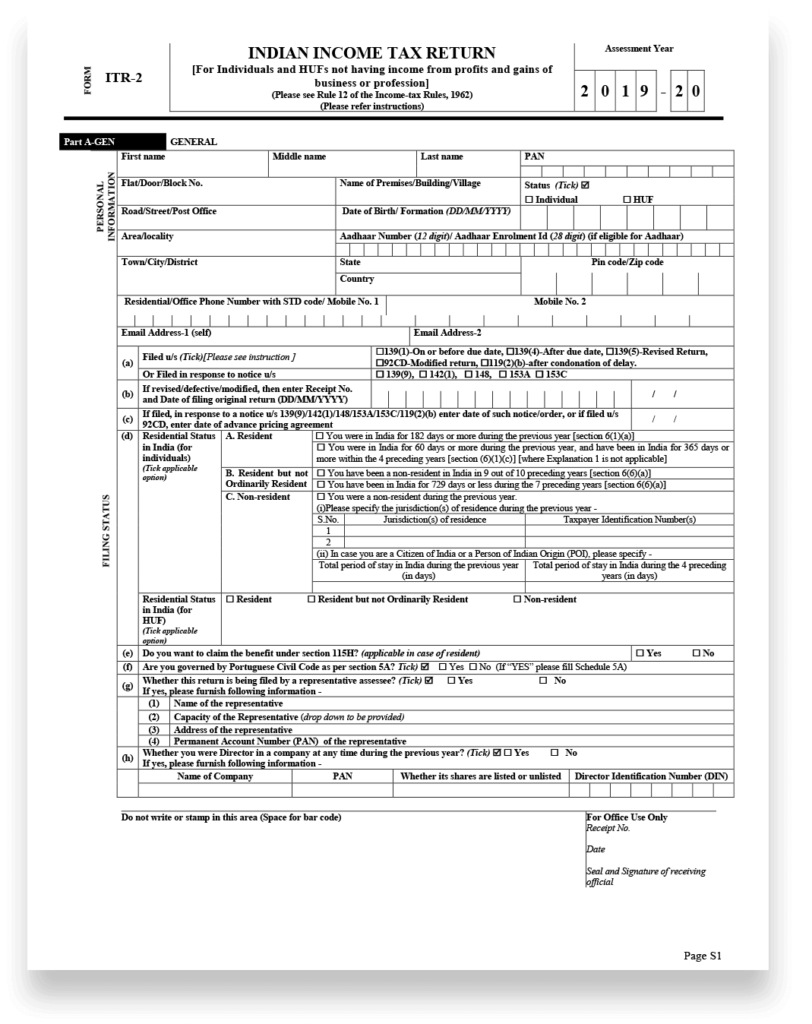

ITR 2 Filing Form

The ITR Form 2 is a valid tax return form used by Indian citizens and NRIs to file a return with the Indian Department of Income Tax. Taxpayers who are not eligible to file ITR 1 can file ITR 2 to file a tax return. ITR 2 may be filed by Indian individuals and undivided households whose income for the fiscal year comes from salary, pension, multiple assets, investment income income, income from foreign property, business or associated professional income and other sources including lottery, horse, racing, legal gambling.

Who can file Form ITR-2?

- Income from Salary or Pension

- Income from House property

- Income from Capital gains

- Income from other sources – Lottery, bets on horses, and other gambling

- Foreign Income

- Agricultural income > Rs.5000

- A resident is not an ordinary resident and is not an NRI

Required Documents to file ITR - 2

- Copy of the previous year’s tax return

- Bank Statement

- TDS Certificate

- Savings Certificate/ Deductions

- Interest Statement that shows the interest that is paid throughout the year.

- Balance sheet, P & I, Account Statement

- Other Audit reports wherever they are applicable.

Structure of ITR 2 Filing

- Name

- PAN number

- Address

- Name of Premises/Building/Village

- Status: Individual or HUF

- DOB

- Area/Locality

- Aadhar number

- Town/City

- State

- PIN Code/ZIP Code

- Contact Number

- Email Address