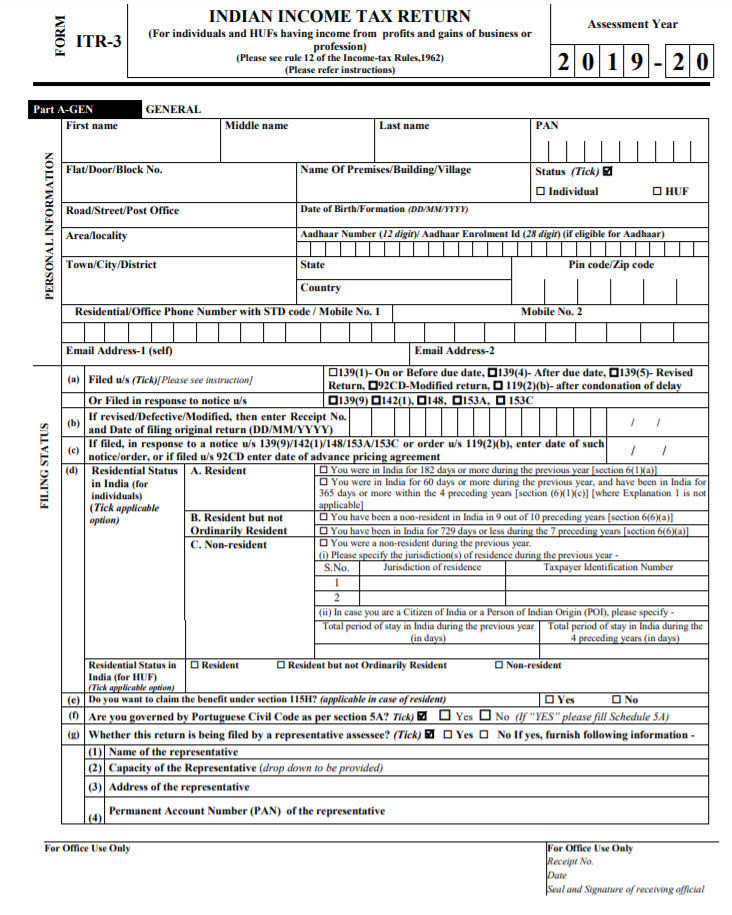

ITR 3 Form Filing

ITR Form 3 applies to Indian individuals and undivided households benefiting from commercial or professional activities. Where an Indian individual or single family earns income as a partner in a partnership, the RTI-3 cannot be filed as in such cases the individual is required to file the ITR-2.

Eligibility to submit an ITR 3 form

- Income from carrying a profession

- Income from proprietary business

- The returns of the business can also include the house property

- Salary or pension

- Income from other sources.

Required Documents while Filing ITR -3 form

- Form 16

- salary slip (If any)

- Rental Agreement ( If any)

- Proof of Rental income (If any)

- Proof of investments

- Form 26AS

- Monthly purchase billl

- Monthly Sales bill

- Sales Return Details

- Purchase return details

- Tax paid challans for GST

- Day to day Administrative expenses and general expanses

- Investment details cash and Bank

- Bank statement

- Loan Details

How to file ITR 3 Form

Offline: Returns can be delivered in paper form using a barcoded return.

Online: Refunds can be made electronically with a digital signature certificate. This data can be provided after the return confirmation has been submitted.