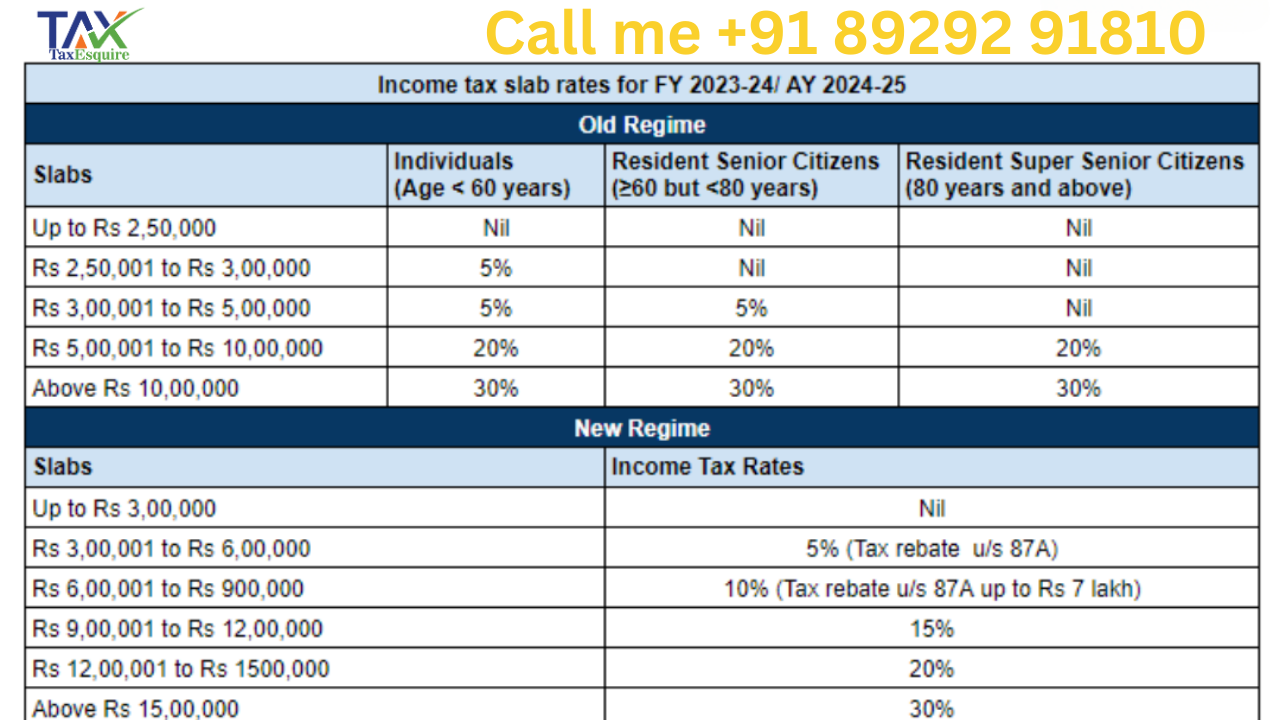

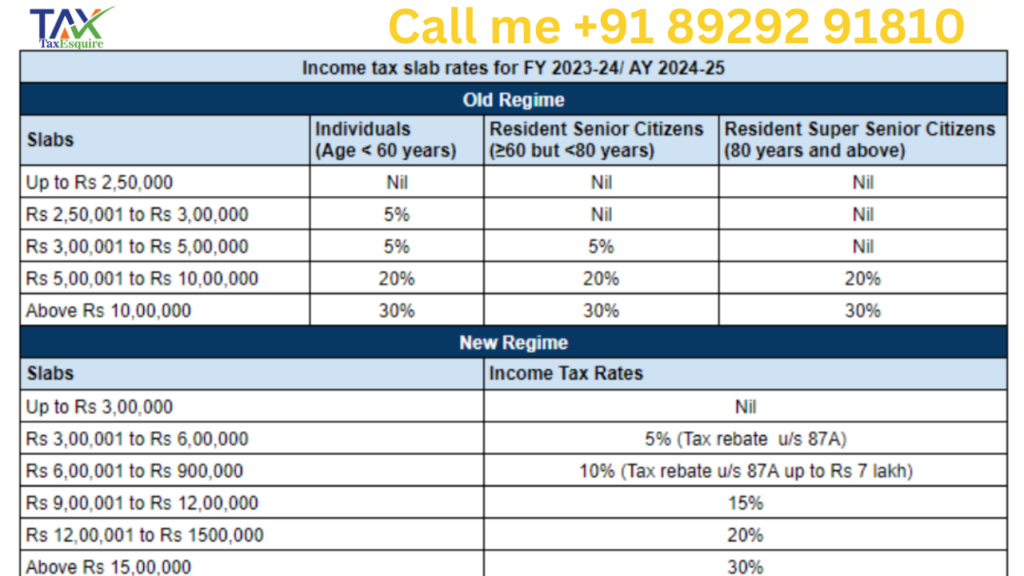

Discover the latest income tax slabs for FY 2023-24 and AY 2024-25. Compare new and old regime tax rates and learn how to calculate your income tax with Tax Esquire’s detailed examples and deductions. Stay informed to maximize your tax savings.”

The old and new tax regimes have different income tax slabs Slab rates are varied into three different types under the old tax regime

- All the non-residents + Indian Residents aged < 60 years

- Senior citizens: Resident 60- 80 years of age1

- Above 80 Years: Resident Super senior citizens2

- Highlights of the Interim Budget 2024-2025

- The Interim Budget 2024-2025 has not provided a single change in the direct taxes.

What is an Income Tax Slab?

India charges Income Tax on people under the slab system including different sets of income with the different tax rates. The higher the person earns the more these rates rise. This type of taxation has led to a notion of fair and progressive tax system in the country.

Income Tax Rebate for Old Regime – An annual rebate u/s 87A for old regime up to Rs. 12,500 if total income does not exceed Rs 5,00,000 (not for NRIs)

NOTE:

- The income tax exemption limit is

- up to Rs 2,50,000 for Individuals, HUF below 60 years of age and NRIs

- above 60 years but less than 80 years Rs. 3,00,000

- up to Rs 5,00,000 for senior supercitizens aged above 80 years.

- Tax rates will exclude surcharge and cess

But, the new tax regime is eligible for rebate upto Rs.25,000 if total income not exceed Rs 7,00,000. (not applicable for NRIs)

* Tax refund values to be specified, tax payable after total income is increased

Comparison of Tax Rates Under New Tax Regime & Old Tax Regime

| Old Tax Regime (FY 2022-23 and FY 2023-24) | New Tax Regime | ||||

| Income Slabs | Age < 60 years & NRIs | Age of 60 Years to 80 years | Age above 80 Years | FY 2022-23 | FY 2023-24 |

| Up to ₹2,50,000 | NIL | NIL | NIL | NIL | NIL |

| ₹2,50,001 – ₹3,00,000 | 5% | NIL | NIL | 5% | NIL |

| ₹3,00,001 – ₹5,00,000 | 5% | 5% | NIL | 5% | 5% |

| ₹5,00,001 – ₹6,00,000 | 20% | 20% | 20% | 10% | 5% |

| ₹6,00,001 – ₹7,50,000 | 20% | 20% | 20% | 10% | 10% |

| ₹7,50,001 – ₹9,00,000 | 20% | 20% | 20% | 15% | 10% |

| ₹9,00,001 – ₹10,00,000 | 20% | 20% | 20% | 15% | 15% |

| ₹10,00,001 – ₹12,00,000 | 30% | 30% | 30% | 20% | 15% |

| ₹12,00,001 – ₹12,50,000 | 30% | 30% | 30% | 20% | 20% |

| ₹12,50,001 – ₹15,00,000 | 30% | 30% | 30% | 25% | 20% |

| ₹15,00,000 and above | 30% | 30% | 30% | 30% | 30% |

Income Tax Slab Rates For FY 2022-23 (AY 2023-24)

a. New Tax regime until 31st March 2023

| Income Slabs | Individuals (for all age categories) |

| Up to Rs 2,50,000 | Nil |

| Rs 2,50,001 – Rs 5,00,000* | 5% |

| Rs 5,00,001 – Rs 7,50,000 | 10% |

| Rs 7,50,001 – Rs 10,00,000 | 15% |

| Rs 10,00,001 – Rs 12,50,000 | 20% |

| Rs 12,50,001 – Rs 15,00,000 | 25% |

| Rs 15,00,001 and above | 30% |

* Tax rebate up to Rs.12,500 is applicable if the total income does not exceed Rs 5,00,000 (not applicable for NRIs)

Refer to the above image for the rates applicable to FY 2023-24 (AY 2024-25) for the upcoming tax filing season.

b. Old Tax regime

Income tax slabs for individuals aged below 60 years & HUF

| Income Slabs | Individuals of Age < 60 Years and NRIs |

| Up to Rs 2,50,000 | NIL |

| Rs 2,50,001 – Rs 5,00,000 | 5% |

| Rs 5,00,001 to Rs 10,00,000 | 20% |

| Rs 10,00,001 and above | 30% |

NOTE:

- The income tax exemption limit is up to Rs 2,50,000 for Individuals, HUF below 60 years aged, and NRIs.

- Surcharge and cess will be applicable.

Income tax slab for individuals aged above 60 years to 80 years

| Income Slabs | Individuals of Age 60 Years to 80 Years |

| Up to Rs 3,00,000 | NIL |

| Rs 3,00,001 – Rs 5,00,000 | 5% |

| Rs 5,00,001 to Rs 10,00,000 | 20% |

| Rs 10,00,001 and above | 30% |

NOTE:

- The income tax exemption limit is up to Rs.3 lakh for senior citizens aged above 60 years but less than 80 years.

- Surcharge and cess will be applicable

Income tax slab for Individuals aged more than 80 years

| Income Slabs | Individuals of Age above 80 Years |

| Up to Rs 5,00,000 | NIL |

| Rs 5,00,001 to Rs 10,00,000 | 20% |

| Rs 10,00,001 and above | 30% |

NOTE:

- Income tax exemption limit is up to Rs 5 lakh for super senior citizen aged above 80 years.

- Surcharge and cess will be applicable

Revised Income Tax Slab Rate AY 2024-25 (FY 2023-24)– For New Regime

| Income Slabs | Income Tax Rates FY 2023-24 (AY 2024-25) |

| Up to Rs 3,00,000 | Nil |

| Rs 3,00,000 to Rs 6,00,000 | 5% on income which exceeds Rs 3,00,000 |

| Rs 6,00,000 to Rs 900,000 | Rs. 15,000 + 10% on income more than Rs 6,00,000 |

| Rs 9,00,000 to Rs 12,00,000 | Rs. 45,000 + 15% on income more than Rs 9,00,000 |

| Rs 12,00,000 to Rs 1500,000 | Rs. 90,000 + 20% on income more than Rs 12,00,000 |

| Above Rs 15,00,000 | Rs. 150,000 + 30% on income more than Rs 15,00,000 |